08.18

After weeks of rumors and speculation, General Electric has confirmed discussions to sell its appliance division. That’s a big concern for LaFayette and the surrounding area since GE Appliances & Lighting owns Walker County’s largest employer, Roper Corp.

Per Businessweek and various other news outlets, GE is seeking to unload the consumer appliance business for $2 to $3 billion, and the most interested potential buyer is Swedish appliance giant Electrolux.

- “‘GE is evaluating a wide range of strategic options for our appliances business including discussions with Electrolux and other interested parties,’ Seth Martin, a GE spokesman, said today. He declined to name other bidders. Electrolux confirmed its interest in a statement, saying there’s no guarantee a deal will be reached.”

General Electric is a massive conglomerate with various interests, including appliances, electrical generation, oil and gas, transportation equipment, medical devices, and light bulbs. Under the control of CEO Jeff Immelt, GE has focused on industrial and infrastructure businesses – core holdings where it can be most profitable. In the last few years GE has successfully sold a plastics factory, real estate, its risky finance unit, overseas banks, stakes in entertainment companies, and tried once before (unsuccessfully) to get out of the appliance business.

While GE Appliances & Lighting DOES make a profit, the division is being considered for sale due to having low margins and little potential for growth – especially compared to the rest of GE. Combining third-place GE Appliances with no. 2 Electrolux would give GE a cash infusion, and put Electrolux in a better competitive position against the biggest US appliance manufacturer: Michigan-based Whirlpool.

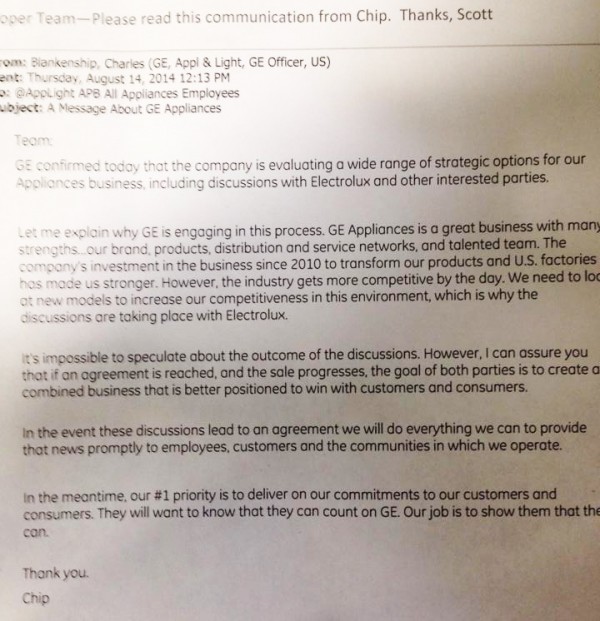

Roper employees in LaFayette received confirmation of sale talks last Thursday via an e-mail from Dr. Charles “Chip” Blankenship, CEO of GE Appliances & Lighting. Blankenship’s message admitted GE is considering an Electrolux deal in order to “increase our competitiveness.” The e-mail promised to quickly make GE employees and communities aware of any sellout or restructuring, but made no firm promises regarding job security once a deal is done.

- “…if an agreement is reached, and the sale progresses, the goal of both parties is to create a combined business that is better positioned to win with customers and consumers.”

That better position likely means lower costs through consolidation. Consolidation generally translates into job cuts or plant closures.

Electrolux already competes with GE Appliances in almost every category. Dishwashers, refrigerators, washing machines, air conditioners, water heaters, and kitchen ranges like those built in LaFayette, marketed under well-known names like Frigidaire, Tappan, and Westinghouse. Electrolux turns out appliances every day by the thousands, and doesn’t appear to need more capacity – meaning they likely just want GE Appliances for its brand strength, distribution network, and technology. And, of course, to eliminate a competitor.

An Electrolux buyout of GE Appliances wouldn’t necessarily mean closing down GE’s Roper division in LaFayette. Not at all. Roper has a good reputation for being cost efficient and has a good rate of production. The unit has been valuable to General Electric over the years – all of the company’s oven production was moved to LaFayette in 2000, and last year GE spent millions to expand and enhance the facility. [More on that below.]

But Roper would have production rivals within Electrolux – mainly a $266 million facility in Memphis, built with $188 million of government subsidies, that began turning out Frigidaire-branded ovens less than a year ago. If Electrolux DOES buy GE Appliances and DOES decide to consolidate its oven production lines, that massive brand-new factory located in a large city two minutes from I-55 will easily win out over a 41-year-old plant in LaFayette half an hour from the closest interstate.

Sales talks are, at this point, just talks and it’s very possible GE Appliances won’t be sold, or will be sold to some company other than Electrolux. Several articles suggest a five-year-old startup company named Quirky is also making offers, but it seems highly unlikely that a business worth less than $100 million that has never made a profit would be able to buy an industrial giant valued at $3 billion. GE and Roper insiders aren’t taking the company seriously, although a deal with Electrolux could also include selling GE’s small investment in Quirky.

GE’s public verification of Electrolux talks may push other competitors to make their own bids and raise the sale price. LG, which considered buying GE Appliances six years ago, might take a second look at the business now. Whirlpool would also have the resources to buy out GE, but would face government resistance in light of their existing dominant position. (Whirlpool and LG are both considered more likely to close Roper than Electrolux would be.)

GE reportedly wants Electrolux to sign an agreement keeping existing jobs and plants going for a number of years after a deal is done. That’s standard in these kinds of arrangements as it would keep GE from taking heat if Electrolux or another buyer immediately slashed jobs after buying the company – but that would only keep Roper safe for a few years.

When and if Roper closes, it will absolutely devastate Walker and Chattooga county. The exodus of 1,300 Roper jobs would crater home prices in two counties, making it almost impossible to sell or rent out a house in the area. All those lost incomes would drag down other businesses like grocery stores, restaurants, and gas stations, forcing those to also cut jobs or just close outright.

Roper doesn’t directly pay property taxes because the factory land belongs to Walker County Development Authority. However, lost jobs, closed support businesses, and a dead real estate market would drastically lower tax revenues for Walker County and the City of LaFayette. LaFayette would also lose up to a half million per year from Roper’s utility usage. Walker County would be stuck with another outdated empty factory to market.

LaFayette has been through factory closures and job losses before – Coca-Cola, Sweetheart Cup, Caron, Vulcan, and many more. All were hard, but the town managed to move on. Losing Roper would blow those away. Roper leaving town would make BlueBird shutting down in 2010 look like nothing in comparison.

Even the bankruptcy of Barwick thirty years ago made less of an impact on the city than losing Roper would now, because at the time we had other major companies in town (Like Roper and BlueBird) to work for. Those days are gone.

LaFayette, Walker County, and surrounding areas have to prepare for Roper to leave. Even if the current sales talks go nowhere, this community cannot depend on one company or even one type of business for survival.

Beyond building industrial parks and attempting to bring in more manufacturers with free land and tax incentives (as the county has done, quite poorly), government AND citizens AND churches AND nonprofits AND the media have to focus on better training and education, on attracting companies that aren’t just manufacturers, on supporting agriculture, on cleaning up government corruption, and on making LaFayette a better place to live so other kinds of businesses will want to relocate here.

That has to happen now, regardless of Roper, and certainly cannot wait until LaFayette’s four-decade relationship with Roper and GE comes to an end.

Roper has been in LaFayette for 41 years but the company’s roots extend back more than a century.

General Electric created the consumer appliance market in the 1910’s with the first electric toasters and HotPoint ovens. Through the 20th century GE expanded into almost every appliance category from stoves to water heaters, refrigerators, dishwashers, air conditioners, and microwaves. During most of that century, GE and Roper alternated between competing with each other and working together.

Roper Corp began in 1919 in Illinois. The company eventually came under control of Sears, which merged it with a manufacturer of lawn equipment before spinning it back off as a separate entity. By the time Roper opened its LaFayette stove plant in 1973, the company was manufacturing ovens, water pumps, mowers, and garden tillers in multiple factories under the Roper brand, and under contract for Sears, Whirlpool, and GE.

In 1988 the relatively small business was fought over by larger competitors. GE eventually bought Roper for half a billion dollars, resulting in a lawsuit from Whirlpool. That legal case was settled when GE gave Whirlpool access to Roper patents and the Roper brand, which Whirlpool uses to this day on low-end appliances made in its own plants. (Roper Corp still exists as the LaFayette unit of GE Appliances but anything built today with the Roper name on it is unrelated and made by Whirlpool. Roper’s yard equipment division was absorbed into Husqvarna.)

After the 1988 buyout, Roper Corp continued to exist in LaFayette as an unbranded, non-union division of GE’s consumer appliance division. A unionized GE range assembly plant existed in Kentucky until 2000 when the two were combined in LaFayette; by that time Roper was the largest employer in Walker County with over 1,800 employees. Additional expansions and upgrades were done in 2002 and 2005.

As the US economy slowed in the mid-2000’s, GE began outsourcing some appliance production to facilities overseas. Even the company’s famed Kentucky Appliance Park was slowing down and rumored to close or be restructured. In 2008 the entire Appliances division – including Roper – was put up for sale, but no buyer could justify paying what GE wanted during a recession.

After 2008 sale plans collapsed, General Electric began investing in its appliance division again and refocused on domestic production. Last summer the company spent a reported $88 million to expand the LaFayette Roper plant, adding a new multi-story metal press that brought some production jobs back to the US from overseas suppliers. That decision was praised by Governor Deal as a “bright spot” in Georgia’s economy, and Deal’s appearance in LaFayette for the plant’s dedication ceremony is featured in several of his campaign ads.

GE’s recent investments were touted as an effort to fix slowing sales and enter the high-end luxury segment of the kitchen appliance market with $2,000 computerized stoves and refrigerators that spout hot water. Profits are holding, but it’s unclear how much the company is actually making from its luxury products vs. what it’s invested to build them in LaFayette and elsewhere.

Some feel that the investments were also made to give the appliance division more “curb appeal” to a potential buyer like Electrolux or LG. Hopefully if Electrolux, LG, Quirky, or someone else DOES buy out GE Appliances and Roper, they’ll see enough value in LaFayette afterwards to keep the local plant running indefinitely.

Hopefully the potential of a sale and closure will also motivate locals to invest into making this a community that attracts, and keeps, more than one type of large business so we can avoid a potential catastrophe.